A less disruptive land value tax

April 11, 2022

Georgism is having a moment. It’s not hard to see why: while Georgism is far from a new idea, modern problems like housing shortages and climate change are lending new urgency to land use policy. While a land value tax (LVT) may only be one part of a broader land use program, LVT proponents argue compellingly that it would alleviate housing scarcity and encourage more livable, vibrant, and sustainable cities, while efficiently raising enough tax revenue to fund new public investments. I won’t rehash the arguments or challenges here (if the concept is new to you, I recommend the links above as background before reading this post). Instead, I want to focus on an under-discussed issue with land value taxation: displacement. I will describe the problem as I see it, and then propose a simple solution.

Why the current instantaneous implied probabilites may be less useful than they seem

February 17, 2022

I’ve been a casual follower of prediction markets for some time, which are a fascinating and promising way to aggregate “wisdom of the crowds” forecasts of uncertain events. But for the reasons Scott Alexander describes in this post and elsewhere, none of the incumbent markets have felt to me like they really nailed the effortless experience necessary to scale for mass adoption to really achieve their potential. That’s why I was excited to learn about Manifold Markets, which takes a usability-first approach to prediction markets. I’ve spent some time in the last couple days playing with it, and have found it fun and pleasantly easy to use, so I’m excited about its future (enough to dust off this blog that I haven’t touched in close to a decade).

Unfortunately, I think it gets some important incentives wrong, which will lead to miscalibrated probability estimates. This is because the typical expected payout differs substantially from the instantaneous implied probability in a way that significantly disincentivizes accurate price setting. I’ll start with a brief overview of how Manifold Markets betting works, then spend the rest of this post elaborating with a concrete example what I believe the issue is. Finally I’ll let you judge if I’m right by placing bets on whether or not Manifold’s developers will be convinced enough by this argument to alter their calculations – making this post something of an experiment in prediction-market-backed open research.

Or: Make Pure Quantum States of Light With This One Weird Trick*

November 26, 2014

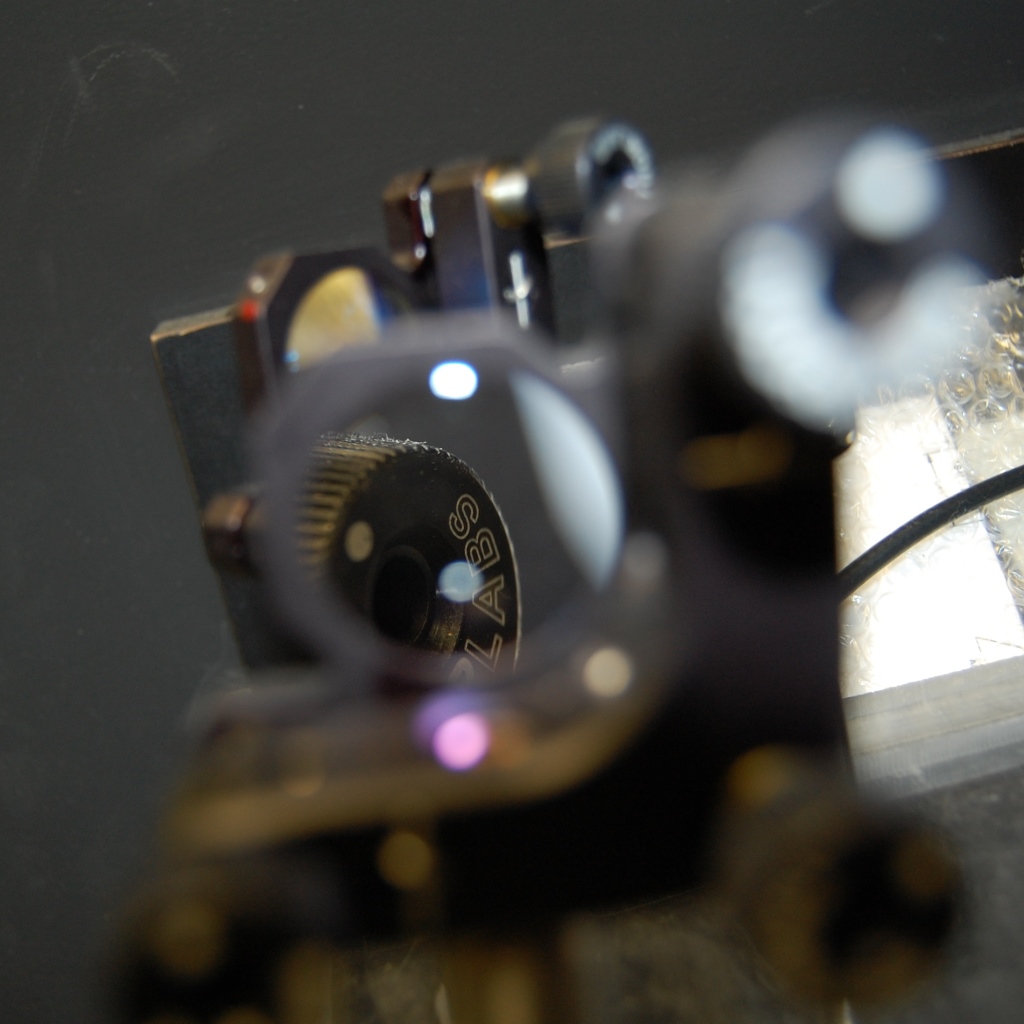

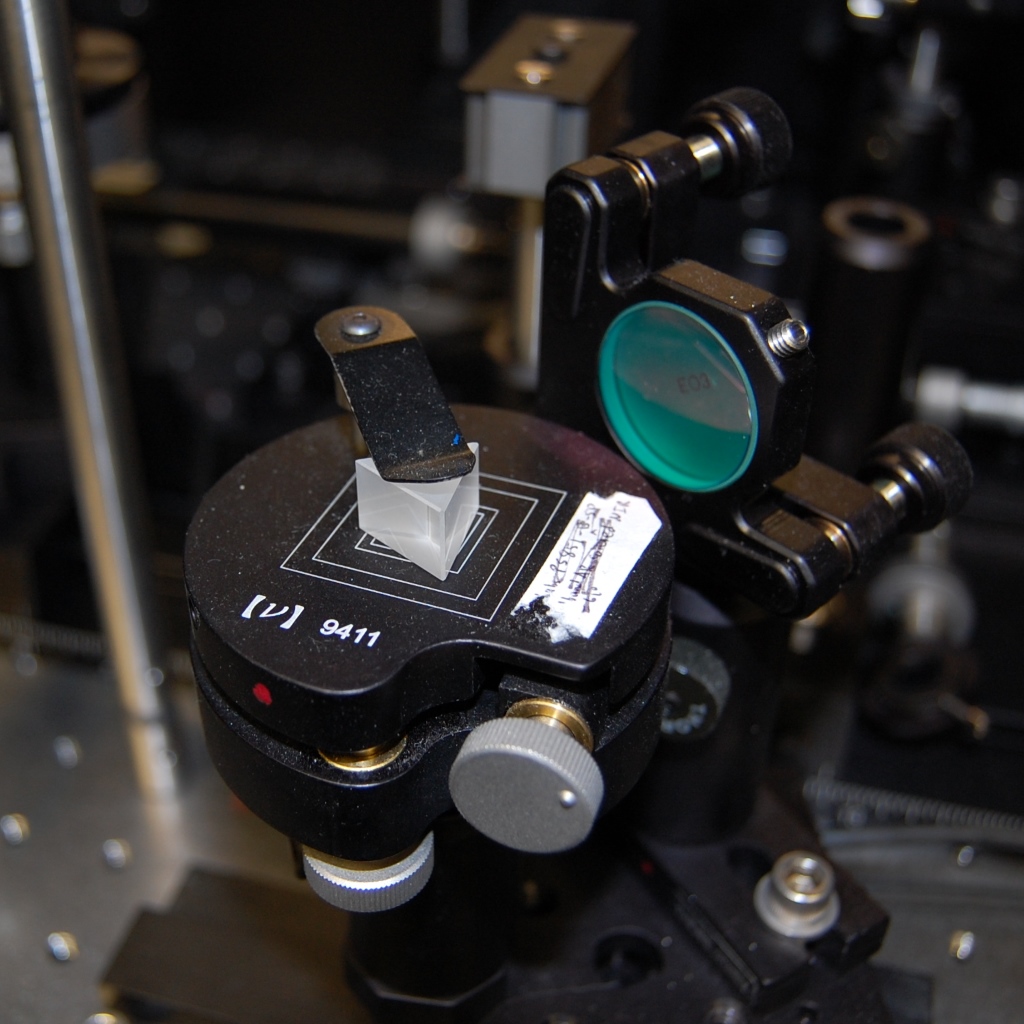

In my past life, I worked as a quantum mechanic in Paul Kwiat’s group at the University of Illinois, where we shoot crystals with lasers and do fun things with photons. In this post I’m going to tell you a bit about my research on producing photons in pure quantum states. I hope anyone with any level of background can get something out of this, but it will help if you know what a photon is, and a little bit about quantum mechanics.

There are many reasons why we might want to produce pure quantum states: for technologies like quantum computing, quantum cryptography and quantum teleportation, or just to better understand the universe. But what do we mean by a pure state?

Tools of the trade: lenses, mirrors, lasers, and prisms

Or: Using Machine Learning to Identify Poetic Comments

January 04, 2014

Sometimes when reading the New York Times comments—between disgruntled complaints, armchair economics, and political banter—one stumbles across that rare gem, the comment poem:

But why should we have to sort through hundreds of regular comments and wait for a poem to catch our eyes? In this age of text mining, big data, and information extraction, shouldn’t a computer be able to do this for us? Well, whether or not this strikes you as a reasonable question to ask, the answer turns out to be yes! I wrote some code to do just that, and to find out how, read on…